How Crypto Bridges Work: Moving Your Assets Across Chains

Discover how crypto bridges allow you to transfer assets across blockchains like Ethereum, Solana, or Avalanche. Learn how they work, why they matter, and the risks to watch out for.

How Crypto Bridges Let You Jump Between Blockchains Without Letting Go of Your Coins

One of the most frustrating things in crypto? You've got ETH on Ethereum, but you see a killer yield opportunity on Avalanche or a hot NFT mint on Solana. Problem: your funds are stuck. Blockchains, by design, don't talk to each other. They're like isolated islands with no ferry between them.

That's where crypto bridges come in, protocols designed to connect different blockchains and let assets flow between them. Whether you're chasing better fees, exploring new ecosystems, or hunting for an airdrop, bridges are the tunnels that make all of this possible.

But how do they actually work? And more importantly, can you trust them?

Why We Even Need Bridges in the First Place

When blockchains like Ethereum, Solana, or Avalanche were created, they weren't built to be compatible. Each one has its own language, its own tokens, and its own way of doing things. That independence is part of their strength, but also a real pain when you want to move value across them.

As more blockchains popped up and DeFi spread like wildfire, developers quickly hit a wall: users wanted to move assets from chain to chain, easily, quickly, and cheaply. Enter bridges: systems that make this cross-chain movement possible, even though the blockchains themselves are not designed to cooperate.

So, What's Actually Happening Under the Hood?

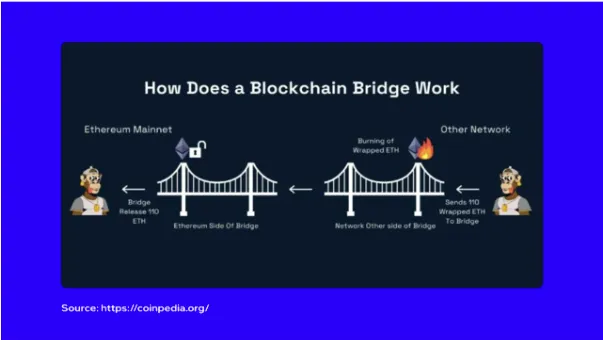

Let's say you want to send 100 USDC from Ethereum to Solana. A bridge doesn't just teleport your coins—that would be magic. Instead, the typical flow goes like this:

You deposit your tokens into the bridge on Ethereum

The bridge locks those tokens

It then mints an equivalent token on Solana (like wrapped USDC)

You now use those tokens on Solana

When you're done, you do the reverse: send the wrapped token back, and the original is unlocked. Nothing is truly moved, just locked, mirrored, and later released. This model is often called lock & mint, and it's the backbone of most bridges today.

Some bridges go a step further with burn & mint (destroying the original version before creating the new one), or use atomic swaps, which skip wrapping entirely by directly exchanging tokens across chains, but that's more complex, and less common for now.

Not All Bridges Are Made Equal

Centralized bridges rely on a trusted third party to hold your coins and manage the transfer. Think of them as traditional banks for crypto transfers—easy to use, but you're trusting someone else with your assets.

Decentralized bridges use smart contracts to automate the process and remove the middleman. In theory, you stay in control, but in practice, the code better be bulletproof.

Still, even decentralized bridges can have critical vulnerabilities, as history has shown. The infamous Wormhole hack in 2022 saw over $300 million drained because of a bug in the smart contract. Ronin Bridge? Lost over $600 million due to compromised validator keys.

Why Use a Bridge At All?

Despite the risks, bridges open up a whole new level of flexibility. Let's say gas fees are too high on Ethereum—you can shift your USDC to a layer 2 like Arbitrum or a faster chain like Avalanche. Maybe Aave on Polygon offers a better interest rate—you move funds there. You're no longer stuck on one chain.

It also means you don't have to sell your ETH to buy AVAX just to use Avalanche. You bridge your ETH, keep exposure to the same asset, and use it across chains. That's huge.

Airdrops, Loyalty Points & Hunting the Next Big Thing

Recently, some bridges reward users with points systems or even hint at upcoming token airdrops. This has created a new meta-game in crypto: use emerging bridges, rack up activity, and cross your fingers you'll be rewarded down the line.

Projects like Portal (Wormhole) have already done this—early users received the W token in one of the biggest airdrops of 2024. So if you're already bridging funds, you might as well keep an eye out for protocols doing similar things.

Why Bridges Keep Getting Hacked

Unfortunately, bridges are often the weakest link in DeFi. Why? Because they touch multiple blockchains at once, they're exposed to every single one of those chains' vulnerabilities. Add to that the complex smart contracts, custody of locked assets, and validators or relayers that need to be trusted, and you've got a recipe for trouble.

Whether it's private key mismanagement (Ronin), smart contract bugs (Wormhole), or just poor design, these systems are under constant attack. And when they fail, it's often catastrophic.

Competing Visions: Are Bridges the Future or a Risky Hack?

Not everyone's convinced this is the way forward. Vitalik Buterin has expressed concerns about cross-chain interoperability. In his view, assets should remain native to their chain—ETH on Ethereum, SOL on Solana—because bridging creates fragile dependencies.

He warns that an attack on one chain can affect assets bridged into another. Say a 51% attack hits Ethereum. The ETH backing your bridged tokens on another chain could be stolen, and now those tokens might be worthless. Scary thought.

Are There Any Alternatives to Crypto Bridges?

While bridges are still the most common way to transfer assets between blockchains, they're not the only option when it comes to achieving some level of interoperability. Other approaches are being explored, or already in use, to help overcome some of the limitations of bridges, especially when it comes to security.

Multichain App Model

One of the most promising alternatives is the multichain app model. Some protocols prefer to deploy their applications separately on multiple blockchains, rather than relying on bridges to move funds. You'll often see this with decentralized exchanges (DEXs) or lending protocols like Aave or Stargate, which have versions running on Ethereum, Arbitrum, Avalanche, and Base. This lets users interact directly on the network they're on, without needing to bridge tokens across chains.

Interoperability Layers

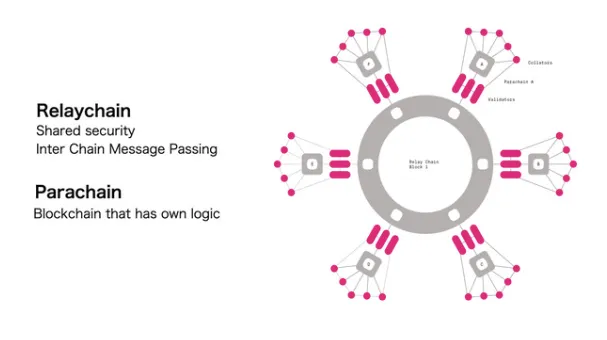

Another promising track is the development of interoperability layers, like Cosmos with its IBC (Inter-Blockchain Communication) or Polkadot with its parachain architecture. These systems are designed from the ground up to allow native and secure communication between compatible chains, eliminating the need for third-party bridges altogether.

Centralized Solutions

Lastly, centralized solutions like exchanges can also act as bridges from the user's perspective. They let you send assets from one chain to another in a few clicks, without ever needing to worry about the underlying mechanism. Of course, this means trusting a third party, but for some, that still feels safer than using a vulnerable bridge.

So... Should You Use Bridges?

There's no one-size-fits-all answer. If you want the flexibility to explore different DeFi ecosystems, bridges are a powerful tool. But they're not risk-free. You're trusting smart contracts, relayers, and a lot of moving parts.

Best practices for using bridges:

Use reputable bridges with good track records

Look for audited contracts

Avoid moving your life savings in one go

Start small and test first

Always ask: is the benefit worth the risk?

Final Thoughts

Crypto bridges are an essential part of the multichain future. They allow your assets to move, adapt, and evolve, just like the space itself. Whether it's yield farming, fee optimization, or DeFi exploration, bridges unlock it all.

But with great power comes great responsibility. If you want to cross the bridge, be sure you're not the one getting burned.

Never Miss Daily Alpha!

Get the latest crypto insights, market analysis, and exclusive tips delivered straight to your inbox daily.

Subscribe to Our Newsletter