What Most People Get Wrong About Long-Term Crypto Investing

Long-term crypto investing isn't about just 'holding.' Discover why most get it wrong, and how to stay smart, steady, and in control through every market cycle.

The Truth About Long-Term Crypto Investing: What Most People Get Wrong

Everyone talks about HODLing like it's the ultimate secret to making it in crypto. As if all you have to do is buy a few coins, forget about them, and voilà—you'll be sipping cocktails on a beach in five years. That's the dream, right?

Well… not quite.

See, long-term investing in crypto isn't just about holding through the dips. It's not about never selling. It's not even about buying the "right" coin at the "right" time. What most people get wrong is thinking that long-term success comes from a single lucky move. In reality, it's about mindset, emotional control, and learning how to stay in the game, even when everything tells you to quit.

The Boring Bit is Where You Win

The wild volatility of crypto gets all the attention. Huge pumps, dramatic crashes—that's what makes headlines. But what really tests long-term investors isn't the chaos. It's the stillness.

Months when nothing moves. Where everyone's silent. Where your portfolio looks flat, and you start wondering if you should "do something."

This is where most people mess up. They get bored. They get impatient. And they swap their long-term plan for the thrill of trading some new token. And just like that, they're out of position for the next run.

Being consistent when it's quiet? That's where the real compounding happens.

Most People Don't Even Know What They're Investing In

Here's a harsh truth: a lot of folks in crypto have no idea what they actually own. They bought a token because someone on Twitter said it was going to the moon, or because it was trending on CoinMarketCap.

But long-term investing requires conviction. And conviction comes from understanding.

Key questions to ask:

What problem does this project solve?

Does it have a real user base?

Is the tech scalable?

Who's building it?

If you can't answer these questions, are you really investing, or just guessing?

And here's the kicker: many don't even realize they're being influenced by narratives. In crypto, hype moves faster than fundamentals. Whether it's "AI-powered DeFi," "Modular blockchains," or the "next Solana," narratives shape market cycles. They grab attention, attract capital, and make average projects look revolutionary—at least for a while.

Understanding these trends, and spotting which ones are driven by substance versus smoke, is essential.

Long-Term ≠ Set-and-Forget

People love the idea of passive investing. But in crypto, "passive" doesn't mean turning your brain off. It means sticking to a strategy, yes, but it also means staying informed, reviewing your assumptions, and adjusting when the facts change.

Let's say a project you believed in two years ago stopped shipping updates. The dev team vanished. Liquidity dried up. Are you still holding out of principle? That's not discipline—that's denial.

You're not married to your bags. You're responsible for them.

Being Early is Not Enough

Being early to a coin or trend feels like a superpower. But if you don't take profits or protect downside, being early can be just as bad as being wrong.

So many long-term investors held through entire cycles, watched their 100x become a 10x, then a 2x, then nothing. Why? Because they confused belief with blind loyalty.

Smart long-term strategy includes:

Having conviction AND having a plan

Setting profit-taking targets

Using stop losses strategically

Taking partial exits to protect capital

It's not about being perfect. It's about protecting your capital for the long haul.

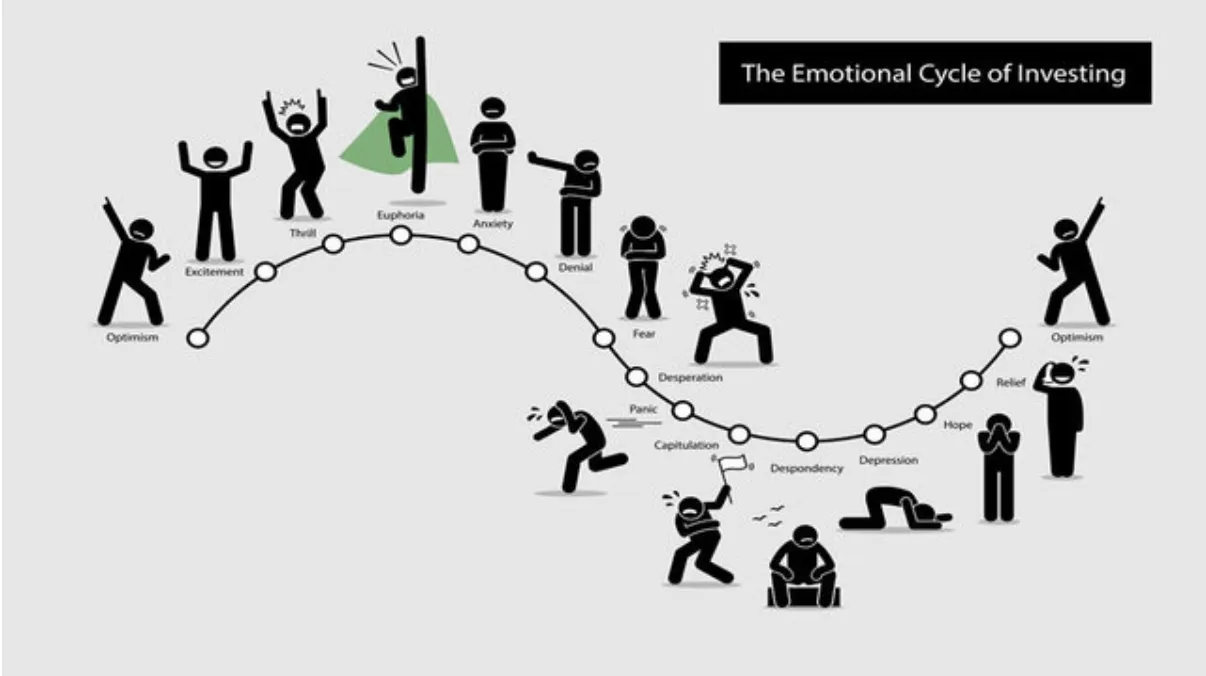

This Is an Emotional Game

Let's be honest: crypto investing messes with your head. One day you feel like a genius, the next you're wondering why you didn't just buy an index fund and move on.

That's the ride. Long-term investors are often the most emotionally disciplined ones. They don't chase pumps. They don't panic sell on dips. But they do feel the pressure—they just know how to respond instead of react.

The Emotional Cycle of Investing © smedleyfinancial

And when things go sideways (because they always do), they don't spiral. They reflect, recalibrate, and keep going.

Taking Breaks is Healthy

Sometimes the best thing you can do is step away. Watching charts all day doesn't make you a better investor—it just messes with your judgment. Obsessing over every move creates stress, not clarity. If your plan is long-term, treat it like that. Set it, monitor it every so often, and focus on living your life.

The Value of Community

Don't underestimate the value of community. The crypto space can feel isolating when markets dip and everyone disappears. But finding a small group of like-minded people, even just a few friends who share your values, can help you stay grounded. Share your doubts, laugh at the chaos, and keep each other accountable. Because let's face it, this whole journey is a bit mad—it's better not to do it alone.

Ignore the Noise, Trust Your Timeline

It's incredibly easy to feel behind in this space. Every week, someone's tweeting about how they turned $500 into $50k with some obscure meme token. But you never hear about what happened after—the losses, the taxes, the rug pulls.

Focusing on your own plan, your own timeline, is a superpower.

If you're investing for 5–10 years, why would you care what some random account is doing today?

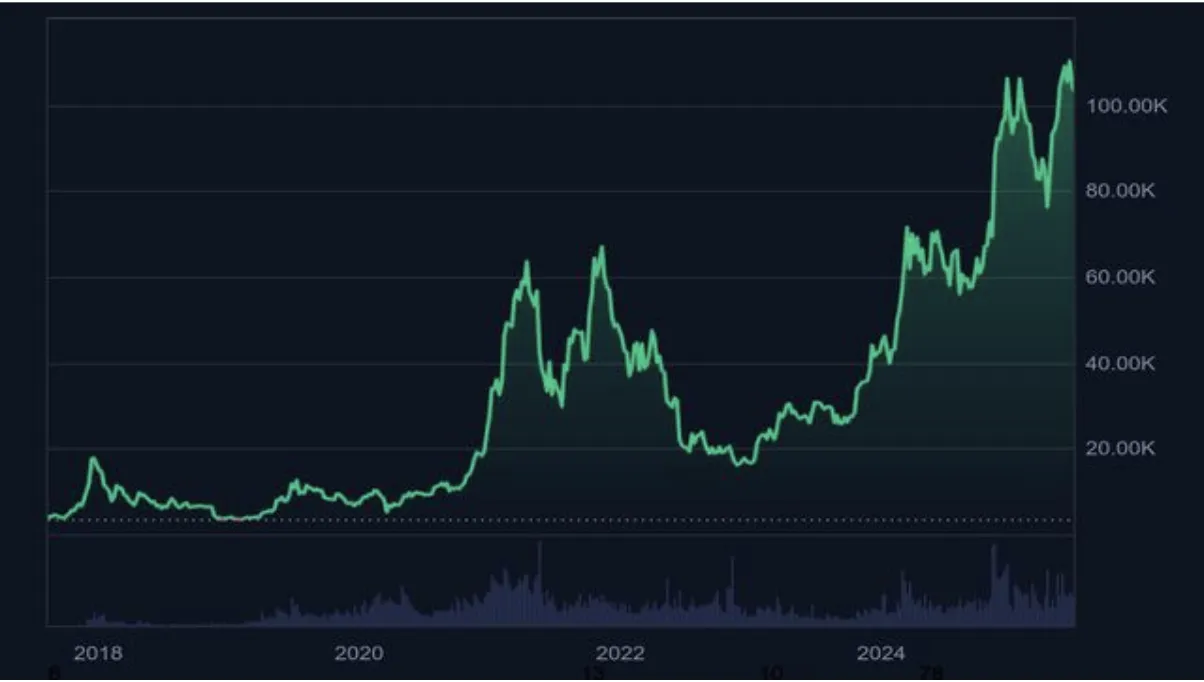

Cycles Repeat. Most People Don't Learn

Crypto runs in cycles. Bull, bear, accumulation, euphoria. It's not exact, but it rhymes. Yet every cycle, people act like it's different this time.

They go all in at the top. They disappear in the bear. They come back when it's too late.

The price of Bitcoin since 2018 © CoinMarketCap

If you learn to spot these patterns and act with patience, not emotion, you'll already be ahead of 90% of investors.

Long-term success is about seeing the big picture, even when short-term chaos is screaming in your face.

Think Beyond Price

One final shift that helps? Stop thinking of crypto purely in terms of price.

Yes, number go up is great. But the more you treat crypto as a get-rich-quick machine, the less likely you are to stick with it long enough to actually build wealth.

Focus on what's being built:

Who's using what

How networks are evolving

Real-world adoption metrics

Developer activity

The price will follow, eventually, but the value comes first.

Key Takeaways for Long-Term Success

Understand what you own - Do your research beyond just price action

Stay informed but not obsessed - Monitor but don't micromanage

Have a plan with exit strategies - Conviction doesn't mean blind loyalty

Manage emotions - Respond, don't react to market volatility

Think in cycles - Learn from history and patterns

Focus on fundamentals - Value creation leads to price appreciation

Build community - Surround yourself with like-minded investors

Final Thoughts

If you think long-term, act long-term, and manage risk with intention… you'll make it. And when the next cycle comes around? You won't be scrambling. You'll be ready.

Long-term crypto investing isn't about being passive—it's about being patient, informed, and disciplined. It's about understanding that wealth in this space is built over years, not weeks. And most importantly, it's about having the emotional fortitude to stick to your plan when everyone else is losing their minds.

The crypto space rewards those who can see beyond the noise and focus on what really matters: building lasting wealth through sound investment principles.

Never Miss Daily Alpha!

Get the latest crypto insights, market analysis, and exclusive tips delivered straight to your inbox daily.

Subscribe to Our Newsletter