Crypto Narratives Explained: How to Spot the Next Big Trend Before It Explodes

From DeFi to AI and memecoins, crypto narratives shape every market cycle. Learn what they are, why they matter, and how to invest before the crowd catches on.

If you've spent even a little time in crypto, you've probably heard people talking about "narratives"—but what does that even mean?

In plain English, a crypto narrative is just a trend or story investors believe in, that makes a certain group of coins more popular for a while. It could be a big idea like decentralized finance, or a more specific tech breakthrough like zero-knowledge proofs. Whatever it is, it grabs attention, it moves markets, and it usually brings a flood of new money into certain projects.

And these narratives? They're not random. Each cycle has its stars. Some pop up fast and disappear just as quickly. Others stick around, becoming long-term pillars of the space. If you can spot them early, you've got a serious edge.

Let's walk through the major crypto narratives shaping the market—not in a boring, robotic way, but with real examples and why they actually matter.

Layer 1 Blockchains: The Foundations

Think of Layer 1s as the ground floor of crypto. They're the base blockchains everything else is built on. Ethereum is the king here, obviously, but over time, loads of new players have shown up trying to improve on what it does—faster, cheaper, more scalable.

You've got Solana, which is blazing fast and has attracted a big wave of retail and dev activity, especially since 2023. Avalanche, which focuses on flexibility and custom blockchains. Cosmos, which is all about connecting different blockchains together. And Celestia, which flips the script by focusing only on data and consensus, letting others handle execution.

Even if no one's "killed Ethereum" yet, some of these projects have carved out real niches. And when narratives turn to scalability or developer friendliness, they tend to shine.

Layer 2s: Solving the Scalability Puzzle

Layer 2s are the answer to Ethereum's old problem: it just couldn't handle the demand. Fees shot up, transactions slowed down, and something had to give.

Enter rollups. You've got optimistic rollups like Arbitrum and Optimism. Then you've got the ZK rollup crew: zkSync, Polygon zkEVM, Starknet. These chains are faster, cheaper, and still benefit from Ethereum's security. And that's why they've been such a massive deal.

Every bull run has its gas fee drama. Layer 2s are always part of the solution, and usually part of the narrative too.

DeFi: The OG Use Case

Decentralized Finance might feel a bit old hat now, but it was revolutionary in 2020. People lending, borrowing, and swapping assets without ever touching a bank? That changed the game.

Uniswap, Aave, Curve, Chainlink, dYdX… these names became household names in crypto. And every time DeFi gets a new twist, like liquid staking or restaking, the narrative gets refreshed.

DeFi's one of those sectors that never fully dies. It evolves, gets quiet, then comes roaring back.

Liquid Staking and Restaking: Yield Without Sacrifice

The whole idea of liquid staking is genius. Normally, when you stake your crypto, it's locked up. Liquid staking lets you get a token in return—a kind of receipt—that you can then use elsewhere while still earning rewards.

Restaking takes that to the next level. You're basically stacking yield on top of yield by using that staked token to secure other networks. Projects like Lido, Eigenlayer, and Pendle are all building in this space. In early 2024, restaking became the narrative to watch.

It's technical, sure, but the promise is simple: maximize what you already hold.

DePIN: Decentralizing Physical Infrastructure

Now, here's a trend that feels very "Web3." DePIN stands for Decentralized Physical Infrastructure Networks. That's a mouthful, but the idea's simple—share unused resources (like computing power or bandwidth) and get paid in crypto.

Think of it as Airbnb for your hardware. Render and Akash are the big players here. They're trying to replace centralized data centers with user-powered networks.

It's not just a cool idea. It's useful, scalable, and lines up perfectly with the values of decentralization.

AI + Crypto: The Crossover Event

This one feels inevitable, right? Two of the most hyped tech trends on Earth—of course they'd mix.

AI needs compute. Crypto (and DePIN especially) offers decentralized compute. So you've got projects like Bittensor and Fetch.ai trying to build open, tokenized systems for AI models to run on.

The architecture of Subnets for Bittensor ©Bittensor

There's also a narrative around using AI for trading, security, and managing decentralized protocols. Honestly, a lot of it is still fuzzy. But when the market's hot, "AI + crypto" is a magnet for capital.

RWA (Real World Assets): TradFi Comes On-Chain

This one's simple. Real-world assets like real estate, stocks, and bonds are being tokenized and put on the blockchain. Why? To make them easier to buy, sell, and use in DeFi.

Ondo Finance, Maple, RealT—they're all trying to bring traditional finance to the crypto world. It's not just a gimmick, either. Institutions are watching this space closely.

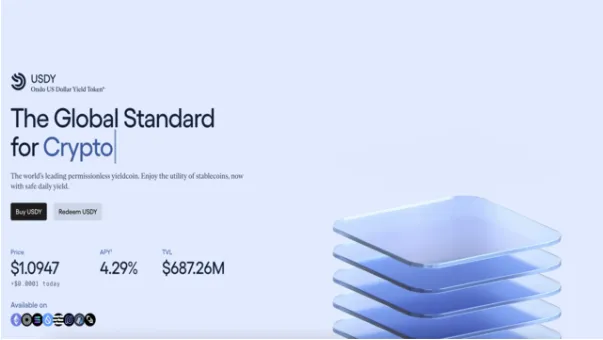

An example of a US Dollar Yield Token available on Ondo Finance © Ondo Finance

If DeFi wants to scale beyond crypto-native assets, RWA is the way.

GameFi and SocialFi: Where Culture Meets Capital

Gaming and social media aren't just fun—they're massive industries. GameFi tried to tap into that with play-to-earn models. Some flopped, some flew. Axie Infinity was a wild ride. Now it's more about "play-and-earn" or economic layers added to existing games.

SocialFi is even newer. Platforms where your followers, your content, even your attention become tokens. It's still experimental, but it's all about ownership—your profile, your posts, your data. Not Meta's.

These narratives attract passionate communities. And in crypto, that often matters more than pure tech.

Memecoins: The Wildcard

Look, we all love to hate them. But memecoins are part of the game. They're community-driven, totally chaotic, and often nonsense—and yet they keep popping off.

Dogecoin, Shiba Inu, WIF, PEPE… they've all had moments. Just don't mistake hype for value. But in the right moment, with the right narrative, these coins can go parabolic.

How to Spot Emerging Narratives Before They Pop

No crystal ball here, but there are clues:

Watch volume spikes on CoinMarketCap or CoinGecko

Follow crypto Twitter (sorry, X) for early signals

See what VCs are backing - follow the smart money

Look at new listings on decentralized exchanges

Monitor developer activity on GitHub and forums

Also, trust your instincts. If something feels useful, or solves a real problem, it might be more than just a passing trend.

Investment Approaches

You can go hands-on: buy native tokens, use the apps, join the communities. Or you can go passive: through curated bundles, indexes, or funds that track specific narratives.

Whatever you do, don't just chase pumps. Narratives are powerful, but they also shift fast. The smart move is to ride them early, not blindly follow the crowd at the top.

Closing Thoughts

Narratives aren't just buzzwords. They shape how capital flows in crypto. They highlight where the energy is, where the builders are focused, and where the next opportunities might lie.

Learn to spot them, understand what drives them, and you'll be ahead of 90% of the market. But always do your homework. Narratives might catch fire, but your money's still on the line.

And at the end of the day, some of the biggest gains don't come from chasing hype—they come from spotting real utility early. That's the trick. That's the edge.

Never Miss Daily Alpha!

Get the latest crypto insights, market analysis, and exclusive tips delivered straight to your inbox daily.

Subscribe to Our Newsletter