Solana, the Ethereum Killer ? A Beginner’s Guide

Discover how Solana's revolutionary Proof of History and fast transaction speeds are reshaping the crypto landscape and competing with Ethereum.

What is Solana?

Solana is one of those crypto projects that gets people either very excited or deeply skeptical. But whether you're a fan or not, you can't deny one thing: it's ambitious.

What Solana's team is trying to do is build a blockchain infrastructure that could actually support real-world businesses at scale. We're not talking about sending a token here and there. We're talking about powering apps that need to move fast, handle loads of data, and be ready for millions of users.

How Does Solana Work?

To do this, Solana leans on some pretty unique tech. You've probably heard of Proof of Stake, which is the consensus system it uses. But there's also something called Proof of History. And while that might sound like just another buzzword, it's actually a clever piece of the puzzle.

Instead of waiting for all the nodes in the network to agree before moving on to the next block (like Bitcoin or Ethereum do), Solana's Proof of History acts like a built-in clock. This lets the network move quicker by letting validators add blocks without having to wait for everyone else to sign off first. It's a bit like giving each validator a timetable to follow so they can all work in sync without constantly asking each other, "Are we good to go?"

On top of that, Solana integrates other tools like Tower BFT (a kind of upgraded Byzantine Fault Tolerance) and Gulf Stream, which help it manage loads of transactions in parallel. Thanks to all that, the network claims to handle over 50,000 transactions per second with a latency of just 400 milliseconds. Sure, it still takes 8 to 12 seconds for a transaction to be fully confirmed, but considering the scale, that's already quite something. And remember, the network is still technically in beta.

Why SOL Matters?

Now, what about fees? Well, here's one of Solana's strongest points. A single transaction costs about $0.00025. That means with one dollar, you can process thousands of transactions. Not bad, right? It makes Solana an ideal playground for microtransactions, high-frequency trading, or any app that writes constantly to the blockchain.

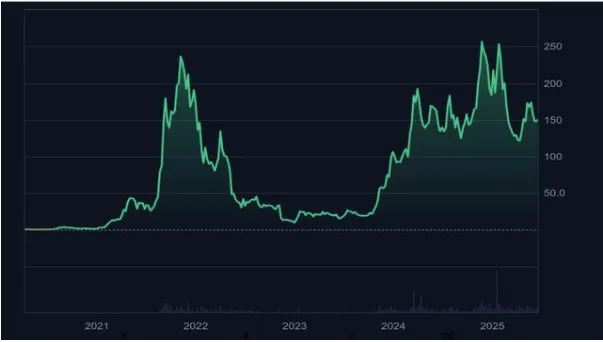

The price of SOL since 2020 © CoinMarketCap.

Of course, none of this tech matters if there's no use case for it. So what does SOL, the token, actually do?

First off, you need it to interact with anything on the Solana network. Want to send a token like Raydium or use an app like Mango Markets? You'll need a bit of SOL in your wallet to cover fees. Think of it as the fuel that keeps the whole machine running.

But more than that, SOL has become a bit of a gateway to the broader Solana ecosystem, which, let's be honest, is trying hard to compete with Ethereum. And it's doing a decent job. Solana offers a similar vision: a decentralized world with apps for trading, lending, music streaming, social media and more. But it claims to do all that faster and cheaper.

There's also the story of Serum, the decentralized exchange backed by Sam Bankman-Fried (yes, that Sam). FTX may be history now, but back when things were booming, SBF chose Solana as the backbone for Serum. That kind of endorsement gave Solana a serious boost in credibility at the time.

Solana hasn't stood still either. In 2022, it introduced a new fee model. If you really want your transaction to go through first, say you're minting an NFT and want to beat the rush, you can add a bit more to the base fee to jump the queue. It's not mandatory, but it gives power users an edge without flooding the network. And according to data, this system is already being used by 5 to 9% of daily transactions, and growing.

On top of that, there's Solana Pay. This is Solana's shot at building the Web3 version of PayPal or Stripe. It lets businesses accept crypto payments directly, without middlemen, fees, or even the risk of chargebacks. And yes, it works with NFTs and stablecoins too. It's still early days, but it gives a glimpse of what crypto payments could actually look like in everyday life.

Popular Solana Applications

If you're curious about what kind of apps live on Solana, here are a few worth checking out:

Audius: a decentralized music platform

Raydium: a DEX similar to Uniswap

Mango Markets: on-chain trading with leverage

Solstarter: launchpad for new crypto projects

Phantom: probably the slickest wallet to manage your SOL and dApps

Raydium, the number one DEX on Solana © Raydium

And if you're planning to grab some SOL, most people go through platforms like Binance or Bybit. Once you have your tokens, wallets like Phantom or Sollet (browser-based) or Ledger (hardware wallet) will let you store them securely.

Now, there are a few misconceptions around mining Solana. You can't actually mine SOL like you would Bitcoin. The network uses Proof of Stake, so if you want to earn rewards, you'll need to stake your tokens or run a validator node, which is a whole different level of commitment.

There's also some farming and staking going on through apps and platforms, including directly through wallets like Solflare or exchanges. It's not risk-free, but it's an option if you want to put your SOL to work.

The Ethereum Comparison

It's hard to talk about Solana without mentioning Ethereum. Ethereum is the OG of smart contract platforms. It has the largest ecosystem, most developers, and countless DeFi and NFT projects.

But Ethereum struggles with scalability. Even with the shift to proof-of-stake and Layer 2s like Arbitrum or Optimism, it still faces high gas fees and slower transactions. Solana, by contrast, aims to solve scalability at Layer 1.

That said, Ethereum has the advantage of maturity and decentralization. It's seen by many as the safer bet, despite Solana's performance edge.

Other Layer 1 Competitors: Avalanche, Sui, Aptos

Avalanche is another speed-focused blockchain. It uses a unique consensus model (Avalanche Consensus) that allows for fast finality and subnets, isolated blockchains for custom use cases. Its ecosystem is strong in DeFi, and it's attracted institutions and gaming projects alike.

Sui, built by ex-Meta engineers, introduces a new model based on "object-centric" data. It's designed for asset-rich applications like gaming and NFTs, with extremely low latency. While early, it has strong backers and a growing ecosystem.

Aptos, another newcomer, also comes from Meta's Diem project. It focuses on parallel execution, aiming for both speed and reliability. Like Sui, it's still gaining traction but is viewed as a potential Ethereum alternative for developers who want newer tech.

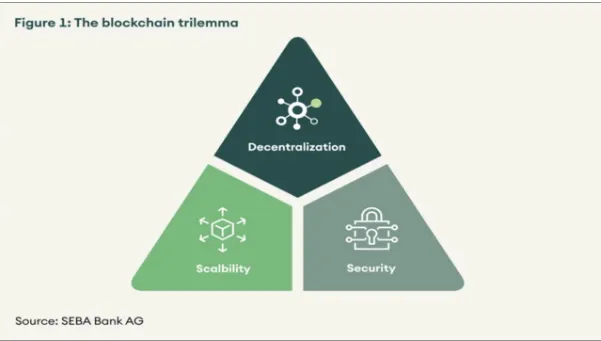

Each of these chains, including Ethereum, Avalanche, Sui, and Aptos, has its own take on the blockchain trilemma: balancing decentralization, scalability, and security. Solana's bet is clear: go all-in on speed and low cost, even if it means leaning a bit more centralized (for now).

The blockchain trilemma © Seba Bank AG

Final Thoughts: Is Solana Worth It?

So is Solana the real deal? Well, it's definitely one of the more serious Ethereum alternatives. It's fast, cheap, and has a growing ecosystem. Yes, it's had its hiccups (including some outages), and yes, it's still evolving. But that's kind of expected when you're trying to rebuild the internet's financial plumbing from scratch.

Keep an eye on it, do your homework, and if you're jumping in, maybe don't bet the farm right away. But it's worth watching. Because whether it becomes the future or not, Solana is certainly trying to build something big.

Never Miss Daily Alpha!

Get the latest crypto insights, market analysis, and exclusive tips delivered straight to your inbox daily.

Subscribe to Our Newsletter